However, it can be completed without using a spreadsheet in most cases. The beginning book value refers to the asset’s value at the start of the year. Are you in the know on the latest business trends, tips, strategies, and tax implications? SVA’s Biz Tips are quick reads on timely information sent to you as soon as they are published. Depreciation calculations determine the portion of an asset’s cost that can be deducted in a given year.

Accumulated depreciation is the total depreciation of that asset for all of the preceding years. If an asset loses 10% of its value each year, for example, after three years, the accumulated depreciation would be 30%. When you compute depreciation expense for all five years, the total equals the $27,000 depreciable base.

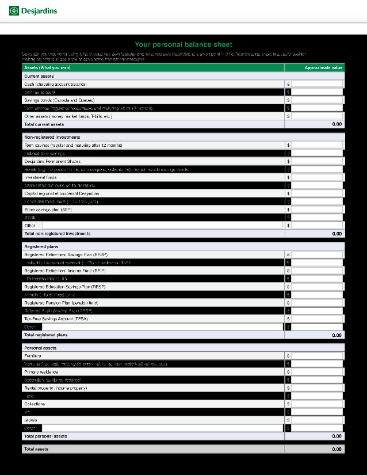

Depreciation as an expense is different from all other conventional expenses. A vehicle’s life will automatically increase with proper maintenance, and more depreciation value results from a lack balance sheet taxes and pensions of maintenance. Some machines that are subject to weather conditions might depreciate more from being idle than from use. There are three methods that anyone can use to determine depreciation.

Contents

Straight-line depreciation method

In accounting, depreciation is the process of allocating the cost of a tangible asset over its useful life. This is necessary because the value of an asset typically decreases over time due to wear and tear, obsolescence, or other factors. Depreciation expenses are recorded on the income statement and are used to reduce the value of an asset on the balance sheet. The units of production method assigns an equal expense rate to each unit produced.

Advisory services provided by Carbon Collective Investment LLC (“Carbon Collective”), an SEC-registered investment adviser. On the other hand, improved maintenance procedures or revision of operating procedures may prolong the life of the asset beyond the original estimate. At the end of the life of the asset, the carrying amount should equal the residual value. The straight line method is widely used in practice because of its simplicity.

How to Calculate Depreciation?

If you don’t claim all the depreciation deductions that you’re entitled to, you will be treated as having claimed them when it comes time to compute your taxable gain or loss on the sale or disposal of the asset. This means you’ll have more gain to report, but you will have lost out on the deductions from your income over the years. Theoretically, the cost of an asset should be deducted over the number of years that the asset will be used, according to the actual drop in value that the asset will suffer each year.

An item will experience increasing wear and tear as its owner uses it more frequently. Mobility, stress, abrasion, eroding, and other factors can all result in the physical degradation of an item. Each part of an item of property, plant and equipment with a cost that is significant in relation to the total cost of the item shall be depreciated separately. If you’re ready to start calculating depreciation, there are 4 common ways to go about it. The methods listed below cover a range of assets, and should be helpful to you and your business. Even though land is considered a fixed asset, it is never depreciated since its useful life is unlimited.

Resources for Your Growing Business

The procedure is extremely helpful in assembling manufacturing lines due to this task. As a result, instead of using the number of years, the estimate depends on the asset’s productive capacity. The main difference between depreciation and amortization is that depreciation is used for tangible assets, while amortization is used for intangible assets.

Assets that may become obsolete quickly are another good fit for this method. Some businesses choose one method for depreciating all their assets while some use two or more methods. The reason for using different methods could depend on the useful life of the asset or the company wanting larger deductions early. Companies have several options for depreciating the value of assets over time, in accordance with GAAP.

- Useful life is either the period over which an asset is expected to be available for use by the entity or the number of production or similar units expected to be obtained from the asset by the entity.

- The useful life of an asset refers to the period of time over which the asset is expected to be useful.

- Several different methods can be used to calculate depreciation, each with its own rules and calculations.

- If production declines, this method reduces the depreciation expense from one year to the next.

It allows a business to more accurately reflect the cost of an asset over its useful life rather than expensing the entire cost in the year it was purchased. It can also help a business manage its cash flow by spreading the cost of an asset over its useful life. Additionally, it is a required accounting practice, as both Indian Accounting Standards and IFRS require businesses to use some form of depreciation when accounting for the cost of tangible assets. Depreciation is a financial accounting term that refers to the allocation of the cost of a tangible asset over its useful life.

Best Free Accounting Software for Small Businesses

Most often the 150 percent declining balance method is used for the same recovery periods as normal MACRS, but you do have the option of using the longer ADS recovery periods as described below. To avoid the mid-quarter rules, don’t be too aggressive about placing a lot of property in service late in the year. However, there may be times when using the mid-quarter convention can work to your advantage.

However, in most countries the life is based on business experience, and the method may be chosen from one of several acceptable methods. Properly accounting for depreciation helps you plan for asset purchases. Posting depreciation helps you monitor the current status of your fixed assets.

The same result occurred if you elected to expense the entire cost of the item. For most depreciable property other than real estate, a half-year convention must be used. This means that no matter what month of the year you begin using the property, you must treat it as if you began its use in the middle of the year. So, you will generally get one-half of the first year’s depreciation, regardless of when you placed the property in service. Again, this principle is factored into the depreciation tables used for most depreciable property.

Concept of Depreciation

Depreciation is recorded as an expense on the income statement, but it’s not an expense of the asset, it’s just a way to spread that cost over the length of the asset’s life. Straight-line depreciation is the most common method used to calculate depreciation. This method assumes that the asset depreciates at a constant rate over its useful life. To calculate straight-line depreciation, you divide the cost of the asset by its useful life in years. For example, if a company purchases a machine for $100,000 with a useful life of 10 years, the annual straight-line depreciation would be $10,000. In the sum-of-the-years digits depreciation method, the remaining life of an asset is divided by the sum of the years and then multiplied by the depreciating base to determine the depreciation expense.

Land Art Today, Beyond Cowboys With Bulldozers – The New York Times

Land Art Today, Beyond Cowboys With Bulldozers.

Posted: Mon, 04 Sep 2023 13:15:49 GMT [source]

As such, there are specific numbers you’ll need for the units of production method. Rather than looking at an asset’s life by the years that it remains useful, you look at how much it can handle. For machinery, it may be the amount of units it’s estimated that it can produce. Like with many accounting practices, there are differences between the IFRS and GAAP standards when it comes to depreciation/amortization.

The Straight-Line Depreciation Method

While asset accounts increase with a debit entry, accumulated depreciation is a contra asset account that increases with a credit entry. This format is useful because the balance sheet will subtract each asset’s accumulated depreciation balance from its original cost. A journal entry increases the depreciation expense and accumulated depreciation, also known as an asset account. Each asset account should have an accumulated depreciation account, so you can compare its cost and accumulated depreciation to calculate its book value. If you own a piece of machinery, you should recognize more depreciation when you use the asset to make more units of product.

Leave a Reply